Rockbridge Growth Equity, a Detroit-based private equity firm, today announced an investment in Quartile Digital, a provider of AI-driven autonomous advertising optimization and spend management software for use by leading brands and sellers across various digital commerce platforms.

The investment will be used to recapitalize the business and support development of direct sales and marketing efforts, product enhancements, and further international expansion. Terms of the deal were not disclosed.

Quartile enables brands and sellers to improve their return on advertising spend and accelerate their sales and profitability across Amazon and other online marketplaces.

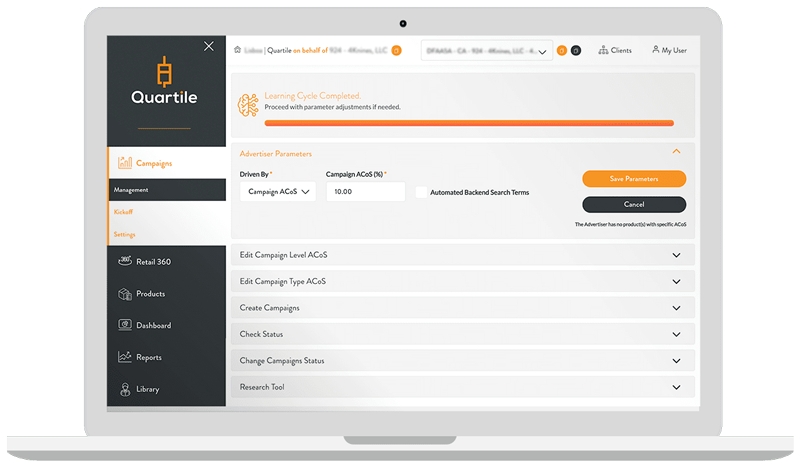

Quartile’s software utilizes proprietary Artificial Intelligence and Machine Learning (“AI/ML”) algorithms to autonomously setup, execute, and optimize thousands of campaigns on behalf of brands and sellers.

The company’s product offers its customers the ability to reach high-intent purchasers and enables bottom-of-the-funnel attribution, making it a particularly attractive tool for merchant advertisers.

Quartile manages ~3 percent of global Amazon advertising spend and supports merchants on all 12 global Amazon marketplaces that currently offer advertising. Quartile customers span a wide array of end markets both here in the U.S. and globally and range in size from less than $1 million in annual revenue to more than $100 million.

“We are excited to partner with Rockbridge given the strong cultural fit and their ability to further accelerate Quartile’s growth,” says Daniel Knijnik, co-founder and CEO at Quartile. “Rockbridge brings expertise in technology-enabled service businesses and direct-to-SMB marketing as well as deep operating knowledge within the digital marketing space that will help advance Quartile’s position as the leading digital commerce advertising management software platform across all platforms and geographies.”

Founded in 2007, Rockbridge Growth Equity invests in financial and business services, consumer-direct marketing, and sports, media, and entertainment industries.

“Quartile provides a differentiated platform to capitalize on two significant trends in the market – a move to e-commerce, which has accelerated due to COVID, and a shift towards high ROI performance-based digital advertising,” says Kevin Prokop, managing partner at Rockbridge Growth Equity. “We are delighted to support Quartile’s next chapter of growth and address the numerous actionable opportunities available to the company.”

Rockbridge owns equity stakes in ProSites, White Glove, Connect America, Rapid Finance, Gas Station TV, Kings III of America, and Robb Report, and is affiliated with other leading businesses in its target sectors including Quicken Loans, the 2016 NBA champion Cleveland Cavaliers, Amrock, and StockX. Since its inception, Rockbridge Growth Equity has invested more than $700 million of equity in its portfolio of companies.

“Daniel and team have built a robust, data-driven platform and are continuing to drive innovation in the industry. We are confident that our investment and expertise will enable Quartile to expand its product offering and scale its customer outreach capabilities,” says Brian Hermelin, managing partner at Rockbridge.

Quartile will join Rockbridge and the Rock Family of Cos., which includes Quicken Loans, the nation’s largest online mortgage lender; Gas Station TV, a digital advertising platform; ProSites, a provider of marketing automation tools for community professionals; and White Glove Workshops, a digital marketing company that provides a comprehensive approach to marketing and seminar planning for professionals in the finance, insurance, legal and real estate industries.

Other enterprises include Rock Connections, a national strategic marketing company specializing in outbound and inbound client service for numerous online, technology, and other businesses; and Bedrock, a full-service real estate firm specializing in acquiring, leasing, financing, developing, and managing commercial and residential space.

The deal closed on September 29, 2020.

Investment bank CG Petsky Prunier, part of Canaccord Genuity, served as the exclusive financial advisor to Quartile in connection with the transaction.

Honigman, a large law firm headquartered in downtown Detroit, served as legal counsel to Rockbridge.

For more information, visit https://www.quartile.com/.

Founded in 2016, Quartile provides advertising spend and optimization software across e-commerce platforms. The company helps sellers, brands, and agencies optimize their advertising spend on e-commerce marketplaces and other online channels, expand market reach, and drive revenue growth.

Quartile’s proprietary advertising technology employs cutting edge artificial intelligence and machine learning algorithms trained on granular historical campaign and transaction data to improve advertising performance.