Detroit-based Peninsula Capital Partners has completed an investment in precision parts manufacturer American Alloy of Spokane Valley, Wash., and has sold its interest in another Washington company, Pro‐Vac, a provider of hydro‐excavation and related services. Terms of the transactions were not disclosed.

The investment in American Alloy was made by the Peninsula Fund VI LP. In the transaction, Fund VI acquired a majority interest in the company from its founder and CEO, who remains in his management role post‐transaction.

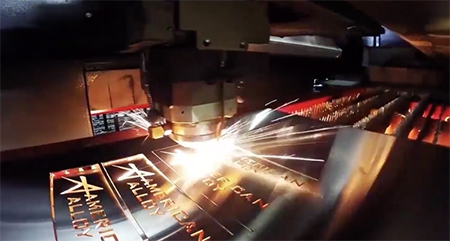

Founded in 2007, American Alloy manufacturers short‐run, precision, metal production parts, and subassemblies that are incorporated into a variety of industrial applications and products. It possesses a broad range of manufacturing capabilities, including laser cutting, water‐jet cutting, shape forming, welding, machining, sand‐blasting, painting, and powder‐coating.

“We review hundreds of investment opportunities a year, many of which are industrial‐focused machining companies, and American Alloy immediately stood out from the pack in terms of the quality of its management team, its efficient operations, commitment to quality and customer loyalty,” says Andrew Wiegand, the Peninsula Capital director at who led the investment.

“American Alloy represents a great opportunity for us to leverage the company’s many core competencies by expanding organically into other customer sectors, and via acquisition of companies with complementary capabilities and operations that may benefit from American Alloy’s sophisticated management practices.”

At the same time, Peninsula Capital Partners sold its interests in Seattle-based hydro‐excavation company Pro‐Vac to RLJ Equity Partners. Peninsula acquired a controlling interest in Pro‐Vac from its founders in 2015.

“Pro‐Vac was a very successful investment for us and a good example of our unique investment approach,” says Scott Reilly, president of Peninsula Capital Partners. “We structured a transaction that both provided meaningful liquidity for the founders while also preserving a substantial ownership position and management role for them post‐transaction.

“We then worked together closely to grow the company’s operations, capabilities, and market reach such that it was an attractive acquisition candidate for a sophisticated buyer like RLJ.”